There is a palpable agony from most real estate agents who have spent the last decade implementing software tools during the cloud computing explosion. It has more or less divided the industry into two camps; those who have developed an appetite for innovation and those who are simply exhausted.

The innovators have often created rods for their own backs, implementing so many subscriptions and tools, that they end up with a bloated stack of tech that creates confusion for their team members, a training and support burden, and fractured information in data sources across the business; not to mention expenses that eat into precious profit. Too many tools can be a significant distraction away from the core business activity of agents – prospect, list, negotiate, sell.

The laggards who tend to get that last bit right, and focus on the human work of real estate can be left behind and miss out on important competitive advantages that allow them to scale their good work. Having your head in the sand about the new and emergent technologies like Ai and automation means that they don’t get a vote in the industry of the future, in fact they may not be able to compete at all.

WE’RE ALL FACING THE SAME FUTURE

Neither camp is immune to progress.

The innovators and the laggards face the same technological revolution that is raging and changing how we live and work, transforming industries and consumer expectations. Whether you have been chasing new and shiny things or whether you still have a fax machine, you need to think about your technology endgame. Forget how much technology you have, and think about the service you are designing for your customers and the workflow that you are creating for yourself.

With the advanced capabilities of artificial intelligence, it is easy to see why people are still asking, “will agents be replaced by a consumer experience that is 100% digital?”. I believe that there are aspects to the work that we can outsource to digital labour, but as a service industry, there are important aspects of our work that are fundamentally human. Empathy, nurture, service.

One thing I know for sure is that the industry we eventually end up with, will be the result of decisions that we make now about HOW and WHY we adopt the technology. A lot of technical tools have been adopted not to augment human work, but instead, to replace it…and the silver-bullet temptation offered by these technologies was so tempting of an apple, that so much of this technology was embraced to play a short game, perhaps without an endgame.

HUMAN vs DIGITAL

Challenging digital tools and the additional layer of separation that a screen can put between the humans of a real estate agency and the humans in the community they serve may seem like a counter-intuitive move from technologists like us – every day is an exercise in pushing that barrier a little bit further in terms of what technology can do to enhance human performance in real estate.

And let’s be very clear – this is not about picking a fight with anyone. What I am saying though, is if there are not enough qualified inbound leads falling into your pipeline, then you cannot forgo the outbound service strategy. Call it “relationship marketing” – the idea of building trust over time through frequency and hyper-personal, hyper-relevant conversations.

WHAT HAPPENED TO SERVICE?

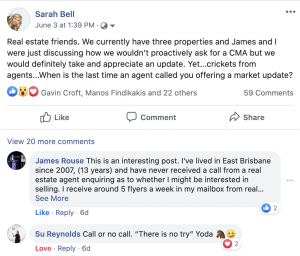

I recently posted to Facebook about a conversation that my husband and I had one evening, more or less daydreaming together about property, I mean who doesn’t. In the wake of Covid-19, we were curious about what our properties might be worth. Unlike most property owners, we are both deeply entrenched in the real estate industry and have access to some of the most up to date data that exists. I believe we possibly could ‘pick’ the prices relatively closely IF we set our minds to it. I repeat, IF, we had wanted to…but we didn’t want to.

It was the end of a long day and I don’t think either of us wanted to be agents at that moment – we wanted to be homeowners and investors. We didn’t want to fill out web forms or download suburb reports from the portals. We just wanted the answers. Some service. Service, we will no doubt repay when it is time to time to sell.

While we weren’t thinking of selling any of the properties, there is always a number that would inspire us to consolidate. We started thinking about how we had never received a call from an agent about our properties. We talked about how in our professional lives we both heard agents reluctant to call the contacts in the CRM because they believed they were interrupting or annoying people.

Yet, in our personal lives, we were homeowners literally crying out for some service. Neither of us had sold in the area of our principal place of residence, one of our properties was in another city and it had been a year since we had even been near the location of the other one. But no one had ever called.

I asked friends on social media when the last time an agent called them about their home and Brisbane Agent Kyla Gale said, “We have never heard from any of our agents x4 different properties & nothing.” Auctioneer, James Rouse, said, “I’ve lived in East Brisbane since 2007, (13 years) and have never received a call from a real estate agent enquiring as to whether I might be interested in selling. I receive around 5 flyers a week in my mailbox from real estate agents, none of which I ever read, and go straight into wheelie bin metres from my mailbox.” A friend and client of mine in Western Australia Rebecca Halton, a CEO of a large LJ Hooker office who frequently renovates properties out of the area to where she works said, “We’ve asked 5 local agents to appraise our home, met them at home opens, called them and even signed up in a Facebook free 24 hour appraisal and crickets!!!!”

I don’t think it is purely anecdotal or an individual case. What we know from studying CRMs and the human engagement between agents and their contacts is that on average, around 80% of property owners in the CRMs across Australia and New Zealand have not had a personal engagement from an agent in more than 6 months.

THE COST OF SERVICE FAILURE

What I also know is that there is a significant cost to that lack of engagement, in terms of lost opportunity. In a 6 month study across a network of offices in 2019, that lost opportunity cost came in at $750,000 in commission lost to competitors, PER DAY. In a deeper analysis, the salient feature across most of those lost opportunities was…disengagement. Disengaged data is when contacts go for 6 months or more without some personalised connection to an agent.

SERVICE SHOULD BE THE ENDGAME

It was around the same time that I read an article about how Artificial Intelligence should be used to cherry-pick the 0.005% of your database that might transact so that you can ignore the rest, implying that this is the outcome of efficiency that agents are after. It is an interesting strategy, which seems appealing on the surface, and it is a combination of two silver bullets that seem pretty hard to resist. A technology that can predict who is going to sell next and an elusive ‘data-lake’ which like a fountain of eternal youth can offer those answers.

Silver bullets are so tempting to believe in but when you start digging a little deeper into how that works, the theory begins to break down AND in practice, we’ve seen the costly consequences of the approach particularly when you have an endgame in mind.

Ultimately, when we break down the difference between the short-game and an endgame it comes down to whether you will adapt to emergent technology and adopt solutions that enhance and scale your human work or focus on the ever-diminishing return of these two shiny silver bullets.

Silver-Bullet One: Predicting who is going to sell next

This is a big one to debunk, because after all Ai is about prediction, and wouldn’t this be the logical thing to predict? Well yes, but also no. Keep in mind there is no such thing aa 1.0 or 100% prediction. Even at the best of times, Netflix is only 93% sure you are going to want to watch The Tiger King.

One thing we have learned from being the first movers in the Ai space in real estate is that the accuracy of predisposition to sell data will NEVER be good enough for agents. The expectation of the prediction is 100%, a bit like how people expect DNA technology to solve 100% of crimes. Can’t be done.

Yes, Ai can include predisposition to sell in a broader algorithm that suggests who agents should speak to and when…but here is what we know from this type of prediction claim elsewhere in the world.

Predictions to sell can be as high as 30% accurate, and that figure comes out of the US where there are a few advantages such as more open consumer data, a larger population providing a larger data sample, and certain cultural ‘norms’ that don’t really apply as rigidly in Australia (for example, teenagers don’t typically leave the nest for university…they linger in the family home for a multitude of individual reasons).

The 30% though that were accurately predicted to sell and came on the market in the following 12 months, were generally not listed with the agents who received the predictions. Why? A couple of reasons: 1. The agents did not ‘believe’ the prediction as it did not convert in a short enough time frame, which then undermines the confidence of all other predictions from the system and the leads are wasted; and 2. The vendors did not choose to list with the agents who received the predictions, favouring their choice of an agent with whom they had existing relationships.

What we learned from watching this approach fail to reach its potential is that asking ‘who is going to sell next’ may be asking the wrong question.

We believe that the better application of Ai is to prioritise and optimise all of your contacts, to mash that against hyper-relevant information from the market and your individual relationship history you have with each client, a dollop of inference from ‘big-data’ and as many data sources as we can get our hands on for you to control the factors around this better question: ‘How can I increase the probability that these people that I know will list and sell with ME’.

It’s not a silver bullet, it might be more like bronze bullet but does offer a long term yield from the most underutilised assets in your business – your data and your people.

Silver-Bullet Two: There is a magical data-lake at Bunnings

The ancient civilisations believed in oracles and the insights from a class of priests when science left explanation wanting. Egyptian priests for example, were the only ones in that society who could read and write and therefore it was easy for them to convince people that they had all the answers. For the everyman in 3,000 BCE, going to these oracles to get predictions was an easy, mysterious, way to get insights and the influence of those oracles was extraordinary and there are hundreds of examples about how the opacity of this practice was used to manipulate society, including its kings.

I worry sometimes that because data science is such a technical field, it lacks the transparency that is required for agents and business owners to trust, or even to distrust it.

Big-data is cool and the more of it you have, the more accurate it can be in terms of the predictions that it can produce. If you watch the show Ozarks (if you don’t you need to it’s amazing), you will know about Marty (Jason Bateman) the money-launderer who has a knack for thinking probabilistically. He describes the power of big-data really well when he is trying to catch cheats and FBI agents who might be working tables at his riverboat casino:

Source: Netflix, 2020

“Listen,” Marty says. “As individuals, people are completely unpredictable. Okay? One person making one bet… I couldn’t possibly tell you what they’re going to do. But the law of large numbers tells me that a million people making a million bets? That is completely predictable. Completely ordered.”

“So,” Marty continues. “You give me a million people walking into this place, I can tell you that 3 percent are trying to cheat us while another 1.2 percent will have been sent here to try to catch us committing a crime. There will be a pattern to how those 3 percent are trying to cheat us, and those 1.2 percent are trying to catch us.”

“Give me a little bit of surveillance and a little bit of time… and I’ll find that pattern.”

Source: bunnings.com.au

It is an excellent piece of script-writing and it kind of showcases how sexy big-data can be…And I believe that it is also where the concept of a magical data lake has come from.

Somewhere along the path to the future where we find ourselves, a rumour has persisted that “if someone on my database bought paint from Bunnings, Ai could tell me who they were because it might predict who is selling,”.

Firstly, if that data about paint purchasing did exist, it would be unlikely that it would be available or affordable for the return that it could give you, remembering that often people buy paint to stay in their houses, too. Bunnings doesn’t collect personal data on casual purchases, you can buy paint, pay cash, and you stay off the grid. But let’s say Bunnings had a CRM with a purchase history for every single customer, (which I reiterate it doesn’t unless you belong to their loyalty program and remember to show that card).

Source: bunnings.com.au

That data, about who is buying paint would belong to Bunnings, to get access to that feed, Bunnings would also have had to invest in technology to share that data with third parties and therefore it would be a pay-to-play exercise to access that data. At this point, I want to stress the unlikelihood of this imaginary scenario playing out because of the utter illegality and breach of the Privacy Principles that this data feed would constitute.

But imagining that it did, you would then need systems to take that feed and match it with your CRM data to find matches of paint purchases with people who you knew and had permission to contact, because you as an agent are also bound by the need to have at least implied consent to market to those people under Australian law.

Once you have narrowed down by who you can talk to x the variable that they have purchased paint, you will want to have some confidence about who might actually be interested in selling. To do that, you will need to add in some additional filters to ensure that you are speaking to property owners, not tenants who are repainting furniture or artists who use that paint for work.

So to refine that data, you will need additional filters from other sources of data such as broader consumers data sets which are wholesaled by a small handful of suppliers in Australia, property ownership data, government census data, average ownership-tenure data and any other relevant information that you can get your hands on, and by ‘get your hands on’, I mean afford, because data supplying is a massive business (that is why Uber, who lose billions of dollars each year on their transportation business, is so valuable).

Now, remember every piece of data in that “lake” that you have access to is available to anyone else who can get their hands on it, I mean who can afford it. In fact, the only data that you did not have to buy in this scenario is the data that is in your CRM, we call this type of data ‘sovereign data’.

We estimate that there are over 350 million contacts in the combined CRMs of real estate agencies in Australia so we can also appreciate a fair amount of duplication of contact records across multiple agencies.

So while your short game in the Bunnings Data Lake (imaginary) scenario, might be to get a lead, you need to understand that this lead is unlikely to be an exclusive one. Do you want exclusive access to Bunnings (imaginary) data feed? Well let the auction begin and the deepest pockets will win, because – you know – life.

So a few agents rock up to a driveway with unsolicited CMAs in tow and the customer has bought paint for Sally’s year 11 art project. I imagine the consumer response will be something along the lines of “Please remove me from your database/s,” or “Dear Privacy Commissioner,”.

Even where this (imaginary, illegal, and impossible) data scenario did coincide with an individual’s intention to sell those multiple agents going into pitch for the business aren’t going in equal. They are going in with the trust equity and the ‘brand’ that they have created through the individual relationships they have created with that client over time.

That doesn’t mean that big-data is not valuable, I think I’ve just shown how it can be used…we just need to remember that it has limitations and it is not the oracle that a lot of people think it is, AND, it is an equalising force that needs to be weighed against the value of the data that you have, which no one else has – and that is the relationship history that lives in the CRM as artefacts of the human service that you have provided to that client, over time.

The endgame of the Bunnings scenario makes leads expensive and competitive. On the other hand, that contact data has been sitting in your CRM this whole time.

A better scenario is that big data lets you know the optimised times and events along the road to develop a relationship with the property owner that is personalised and relevant. Homeowners want service at the right time and for the right reasons, and not every ‘service’ experience will result in a listing. It will, however, increase the number one differentiating factor that can’t be bought or replicated – a relationship of trust between you as the agent and the property owner in your community.

Notwithstanding, Bunnings do have wonderful sausage sizzle. I have a 100% confidence level that if you like a sausage in bread, you will like a sausage in bread from Bunnings AND you can take your dog shopping.

SILVER BULLETS AND SILVER LININGS

Silver bullets are always so beautiful to believe in, but remember if there was an easy way to do this – everyone would be doing it that way. It is easier as well to sell a silver bullet short game than it is to care about the end game. One of the things that I am immensely proud of at AiRE is that our team digs deeper and challenges these silver bullets, creating simple solutions and always seeking a deep understanding of the problems we solve for the real estate industry and their customers.

The silver lining on the other hand is the opportunity that exists in this piece. I have just told you that 80% of the clients in your CRM are likely to have not had a relevant, personal connection with you in more than 6 months. Augmenting that opportunity is the reality that 80% of the contacts in your competitor’s CRMs have also not had a relevant or personal connection with your competitor either.